Corporate Taxes and How They Work

Let’s talk about Biden’s proposed tax policies and how they will affect business and corporate taxes. Keep in mind these are all just proposals. Biden is not even president yet, and these have to pass through Congress for them to become law.

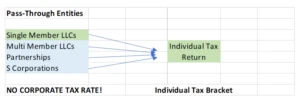

To understand corporate taxes, you’ve got to understand the difference between pass-through entities and those entities that are not considered pass-through entities. If you are a business owner, you may have one of the structures listed on the left in the table below.

In the left column, you have single-member LLCs, multi-member LLCs, partnerships, and S-corporations. The entities in blue will file their business tax return but the single-member LLC will file its tax return on the individual owner’s Schedule C. Although the entities in blue file their tax return they do not pay taxes as an entity. What all four of these entities have in common is that their income will flow to the personal tax return of the business owners. Therefore, taxes on the income of the business will be calculated based on the individual tax bracket of each owner. Refer to this blog post for a more detailed explanation of individual tax brackets. The one entity you do not see on here is a C-corporation. A C-corporation is typically a larger company that sells stock. Most publicly traded companies are C-corporations. C-corporations pay their taxes based on the corporate tax rate.

Increase in the Corporate Tax Rate

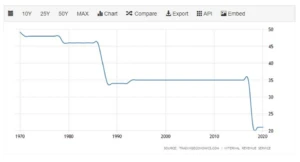

The first major change for businesses in Biden’s proposal is to increase the corporate tax rate from 21% to 28%. Although this change proposed by Biden might seem like a large jump, it really is not. The Trump tax reform reduced corporate tax rates 14% from 35% to 21% which had a huge benefit for large companies, namely C-corporations.Remember that most publicly traded companies are C-corporations and C-corporations usually only make sense for larger companies. That means that most of the benefits under the Trump Tax Reform went to larger companies. It was calculated at one point that Apple benefited $6 – $7 billion from the Trump Tax Reform!Biden is looking to increase those taxes slightly. The 35% tax rate before the Trump Tax Reform was still low in terms of historical corporate taxes. Looking at the historical data of corporate taxes over the last 50 years in the table below, 35% was the lowest rates had been over the past 50 years. At one point the rate was as almost as high as 50% and has been on a steady decrease since.

Impose a Minimum Tax on Corporations

The second major change for business in Biden’s proposal is to impose a minimum tax on corporations with profits of $100 million or more. The minimum tax works like the individual Alternative Minimum Tax. The Alternative Minimum Tax for individuals ensures that all individuals pay a specified minimum tax. The minimum tax on corporations is the same thing but applies to high performing or high-profit corporations. It ensures that these high-profit corporations are paying a minimum amount of tax and not using strategies to skirt paying their taxes.

Increase in the Foreign Earned Income Tax

The third major change for business in Biden’s proposal is to double the taxes on foreign earned income of U.S subsidiaries. I think his goal with this one is to encourage businesses to return to the U.S. rather than having their business outside of the country.

Establish the Manufacturing Communities Tax Credit

The fourth major change for business in Biden’s proposal is the establishment of the Manufacturing Communities Tax Credit. This tax credit is designed to reduce the tax liability of businesses that experience workforce layoffs or a major government mandated institution closure.

Expand the New Markets Tax Credit

The fifth major change for business in Biden’s proposal is expanding the New Markets Tax Credit and making it permanent. The New Market Tax Credit is a credit that incentivizes investors and developers to invest money into low-income areas. Developers and investors have participated in thousands of development projects because of this tax credit. It is a good tax credit to help develop lower income or “forgotten” areas. The downside of developing these areas is that the people who live in those areas before redevelopment can often not afford to live there once the redevelopment is completed. There are certainly some downsides to re-development.

Establish Tax Credits for Workplace Retirement Plans

The sixth major change for business in Biden’s proposal is adopting a tax credit that will incentivize small businesses to adopt retirement plans for their employees. This is a great tax credit for several reasons. First, retirement plans are a great tool to defer your income. Second, they help small businesses retain good employees. Third, they are a good way to diversify your portfolio.

Expanding Several Renewable-Energy Related Tax Credits

The last major change for business in Biden’s proposal is expanding several renewable-energy related tax credits. This includes tax credits for carbon capture, use, and storage as well as credits for residential energy efficiency, a restoration of the Energy Investment Tax credit and the Electric Vehicle Tax Credit. Biden is looking to expand renewable-energy related tax credits which is a great thing because renewable-energy is the future. In cooperation with expanding the renewable-energy incentives, he plans to remove any subsidies that are currently in place for fossil fuel manufacturers.We are here to help. If you need assistance understanding how these proposed changes will affect you and your business, reach out to us at nguyencpas.com or support@nguyencpas.com and schedule a complimentary consultation with one of our advisors.